What Is The Difference Between A Money Market And A Savings Account

6 Min Read | Sep 27, 2021

When you were lilliputian, saving money looked like putting every dime of your assart in a piggy depository financial institution. The plug in the bottom was hard to open up, and the slit at the top was too small for your chubby little fingers to fit through. And so when the ice foam truck came around, information technology seemed impossible to get your coin out—and for good reason. Whether you realized information technology or not, that hard-to-open piggy banking concern was instruction you how to salve your money.

And now that you're older and saving for things that are much more expensive than an ice foam sandwich, you lot really tin can't afford to pull the plug on the piggy bank. But you lot besides need a meliorate place to park your money. You've probably heard that your best two options for saving are money marketplace accounts and savings accounts.

Merely which is better? Don't worry—we've got the scoop on when information technology's right for y'all to utilise a money market versus savings account.

What Is a Savings Account?

A savings account is a free business relationship you tin can open up with your local bank. It gives you a safe place to put your hard-earned money that yous won't (or shouldn't) be touching for a while. Yous might be asked to keep a minimum balance in your savings account at all times, just your bank could throw in a complimentary checking account.

Calculate the growth of your money market account with this gratuitous tool.

Think of it this way: Checking accounts and savings accounts are inseparable best buds. They doeverythingtogether. Merely on pinnacle of having your checking account's dorsum in example of an overdraft, the savings account can actually earn you lot money. If we're honest, information technology'southward nothing to write home about. We're talking pennies on the dollar . . . but that'due south okay! With this savings business relationship, you're not worried about your rate of return. Think of it every bit a safer version of your honey childhood piggy bank.

What Can I Wait From a Savings Account?

From an everyday, run-of-the-manufactory savings account, you can wait:

- A express number of transfers or withdrawals per month (no more than six)1

- A (very) modest rate of interest

- A safety place to keep money you won't exist using for a little while—ahem, similar your starter emergency fund

Besides, be aware of any fees that come with a new savings business relationship. A lot of the time, y'all'll have to meet a minimum balance to escape them.

What Is a Money Market Account?

A coin marketplace account is a type of savings account that gives y'all a run a risk to earn a college charge per unit of interest on your account residual, go along your money safe and sound, and take more access to your business relationship than a typical savings business relationship (think checks and debit cards). Y'all'll probably also need to make a college initial deposit or go on a higher monthly balance in your money market place business relationship.

The money market account and the savings account are kind of like siblings. They've got similar Dna, merely they notwithstanding look (and act) a little differently. That being said, in that location are a few places where you could open up your money market account:

- Your local depository financial institution

- An online bank

- A mutual fund company

Like we said earlier, money market accounts give you the opportunity to earn a college rate of interest on your account balance. Only listen closely:Your main goal in using a money market account isn't to make money.That comes after.

Proceed in heed that if you're withal paying off all of your debt, yous might not want to open a money market account with a mutual fund company. There'south a college adventure of losing your difficult-earned money in the short term and less liberty to encompass those unexpected emergencies.

Money Market vs. Savings: What's the Difference?

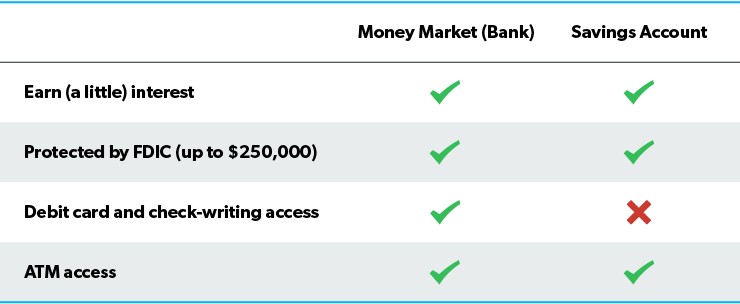

Hither's the bargain: Both money marketplace accounts and savings accounts are great for stockpiling cash. The biggest difference you'll find betwixt money market accounts and savings accounts is the amount of admission yous have to your money. A savings business relationship limits you lot to six or and then transactions per month, while a money market account gives you the liberty—and flexibility—of writing checks. It sometimes even comes with a debit card.

Let's compare money market and savings accounts a niggling more closely:

Both money market accounts and savings accounts at banks protect y'all in case your bank goes under. The FDIC, or Federal Deposit Insurance Corporation, will encompass your deposits in both of these accounts all the manner upward to $250,000. Only not all money market accounts take this luxury.

Quick note: Money market accounts are very different from money market place fund accounts (sometimes called money market mutual funds). Money marketplace funds live in the investment globe—which means if you park your savings there, you're taking the risk of losing your money. But if y'all're not gear up to start investing and you're just looking for a proficient identify to save some greenbacks, you'll want to stick a regular money market account at a trusted bank.

Both a money market and savings business relationship besides requite yous the opportunity to earn interest—a really pocket-sized amount of involvement—depending on your banking concern'south electric current rates. But don't forget: This is a savings account. You're not actually trying to make coin on this money. You're trying to save for specific purposes like emergencies, a downward payment on a house, a family unit vacation, or even side by side twelvemonth's Christmas fund.

Which Business relationship Should I Choose?

Here'due south the thing: It really depends on where you're at in your wealth-edifice journey—or equally we call them, the 7 Baby Steps.

Baby Stride 1 is saving upwardly $one,000 strictly for emergencies. That starter emergency fund would work all-time in a regular ole savings business relationship—especially considering some money market place accounts require a minimum deposit higher than $one,000.

By putting your starter emergency fund in a savings business relationship, you'll still be able to admission it, but information technology'll be a picayune harder than swiping a menu or writing a cheque to get to it. Of form, you'll nonetheless have the power to make online transfers between your checking and savings accounts. (Remember: Your checking and savings accounts are best buds.) This is where discipline comes in—don't bear on it!

You lot'll go out that $1,000 in at that place as y'all work on tackling all of your debt (Baby Step 2). In one case you're debt free (woo!), you'll start working on saving three to half-dozen months of expenses in a fully funded emergency fund (Infant Stride three). Every bit you see those dollar signs add upwards, you'll want to put that cash in a coin marketplace account. Not only volition it be safe and secure, but you'll also have better access to it in instance life throws a surprise your style.

No matter where you're at, saving for life'southward large events is always a good idea. Learn how to walk the Baby Steps one step at a time in Financial Peace Academy—available only in Ramsey+. FPU has helped millions of people learn how to give, salvage and spend similar no one else. And your Ramsey+ membership too comes with admission to the premium version of the EveryDollar budgeting app to rails your spending and savings.

Start your Ramsey+ complimentary trial today!

About the author

Ramsey Solutions

Source: https://www.ramseysolutions.com/banking/money-market-vs-savings

Posted by: cisnerosthatten.blogspot.com

0 Response to "What Is The Difference Between A Money Market And A Savings Account"

Post a Comment